Accounting challenges quietly grow in the background until they start affecting cash flow, compliance, and strategic decisions. Below are the most critical issues businesses face today and how ATS addresses them.

Many businesses begin with basic tools or spreadsheets. While cost-effective initially, these setups fail as the business scales, leading to zero real-time visibility and manual errors.

Delayed entries, misclassifications, and missed reconciliations lead to unreliable financial statements, tax mismatches, and management decisions based on incomplete data.

Profits don't guarantee stability. Poor receivable tracking, unplanned payouts, and lack of forecasting often lead to cash crunches in otherwise successful firms.

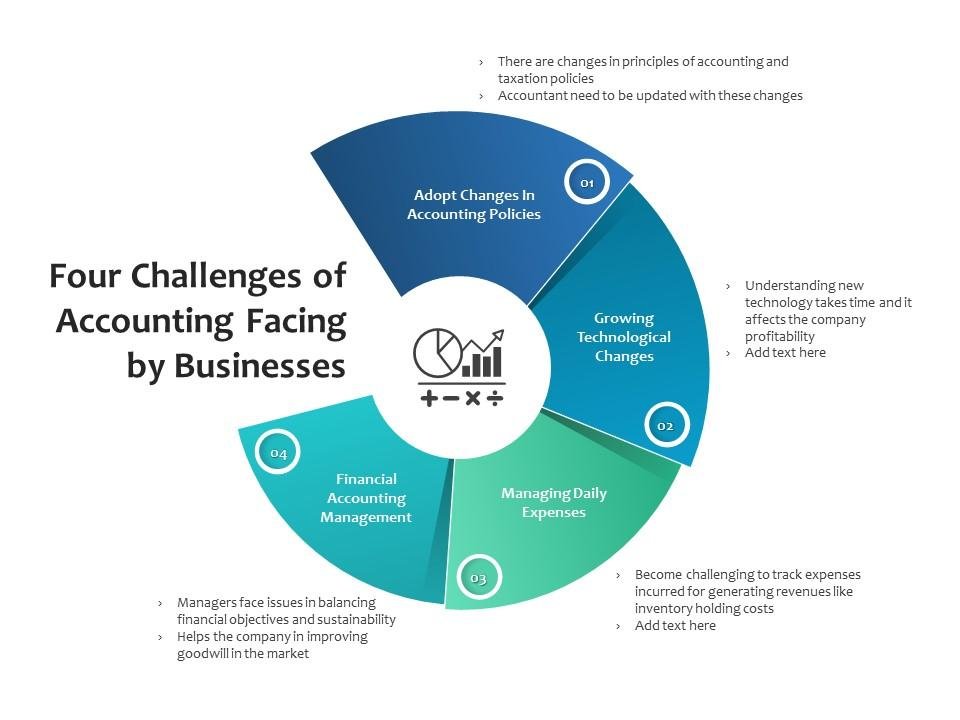

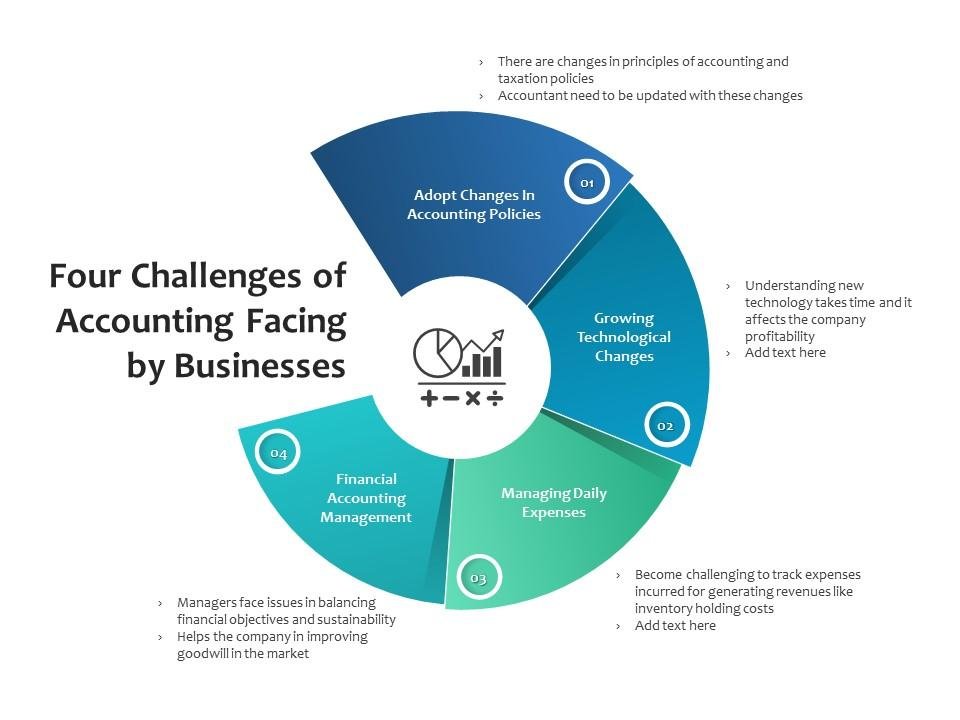

Statutory filings evolve continuously. Without proper tracking, compliance becomes reactive, leading to notices, penalties, and management distraction.

Accounting often stops at recording transactions. However, management needs dashboards, KPIs, and clarity on margins to make strategic decisions.

When knowledge sits with one person, continuity is at risk during exits or leaves. This leads to disruption and inconsistent outputs.

Growth increases complexity—but accounting practices often remain unchanged. This results in reporting delays and strategic blind spots.

We act like a third partner in your business—quietly organizing, controlling, and strengthening your financial backbone.

We observed that while resources are abundant, they are often unskilled for practical performance. To address this, we launched Training Sessions focused on bridging the gap between theory and actual industry requirements.

Now we are reaching out to candidates to train and staff them at client locations, recognizing talent by moving them to better places when required without disrupting the client's operations.